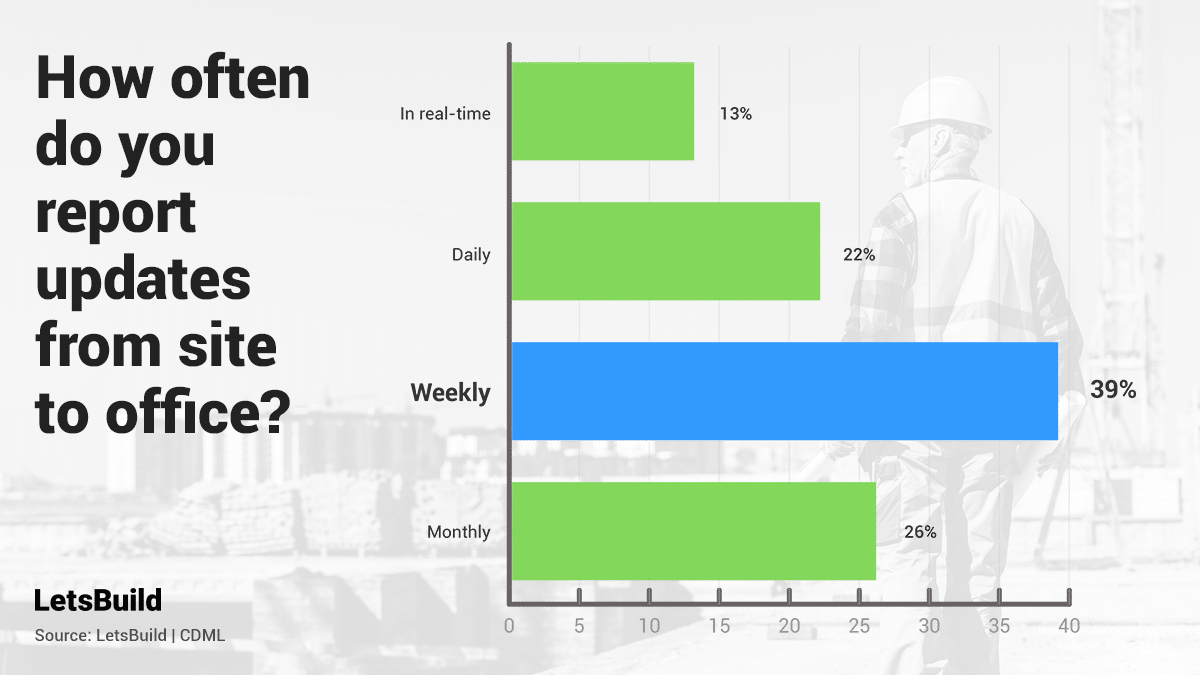

How often do you report updates from site to office? A simple but crucial question for the outcome of every project in construction. As shown by LetsBuild’s Construction Digital Maturity Ladder (CDML), just 35% of all respondents report progress from the field in real-time or daily. The rest 65% connects with the boardroom weekly (39%) or even worse monthly (26%).

It doesn’t take much to understand that if our goal is high productivity, reduced building cost and fewer reworks, these numbers are simply not good enough. In the worst-case scenario, stakeholders in construction must report from the site at least once a day.

Otherwise, everybody will end up working on an outdated version of the project wasting a great amount of time and resources. Of course, this transformational journey goes through digital technologies and user adoption.

The creation of a common digital language across the whole construction industry could be the first and most decisive step for data-driven decision making and efficient team collaboration.

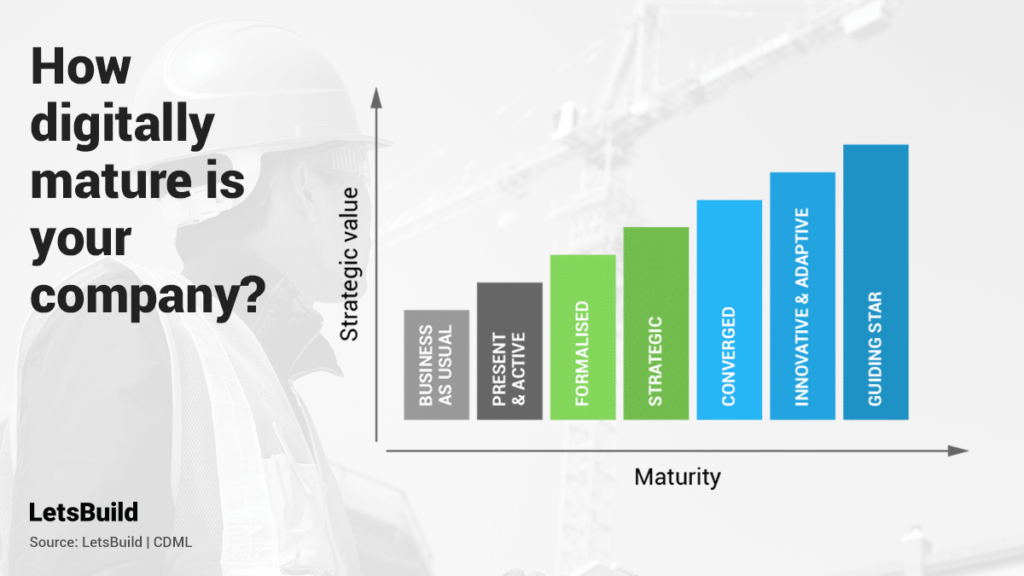

In the end, the question that matters the most is the following: How digitized is your company?

In an effort to answer this burning question, LetsBuild built the Construction Digital Maturity Ladder (CDML), a free online digital maturity assessment which allows construction companies to see how far they are on their digital journey and compare themselves to the other players of the industry.

“LetsBuild’s free and open-source model was launched with the purpose of creating a common language on how to talk about and work with digital maturity in construction,” explains Ulrik Branner, executive and board member at LetsBuild.

In this article, we will take a closer look at the collected data and discover some of the most eye-catching industry patterns and habits.

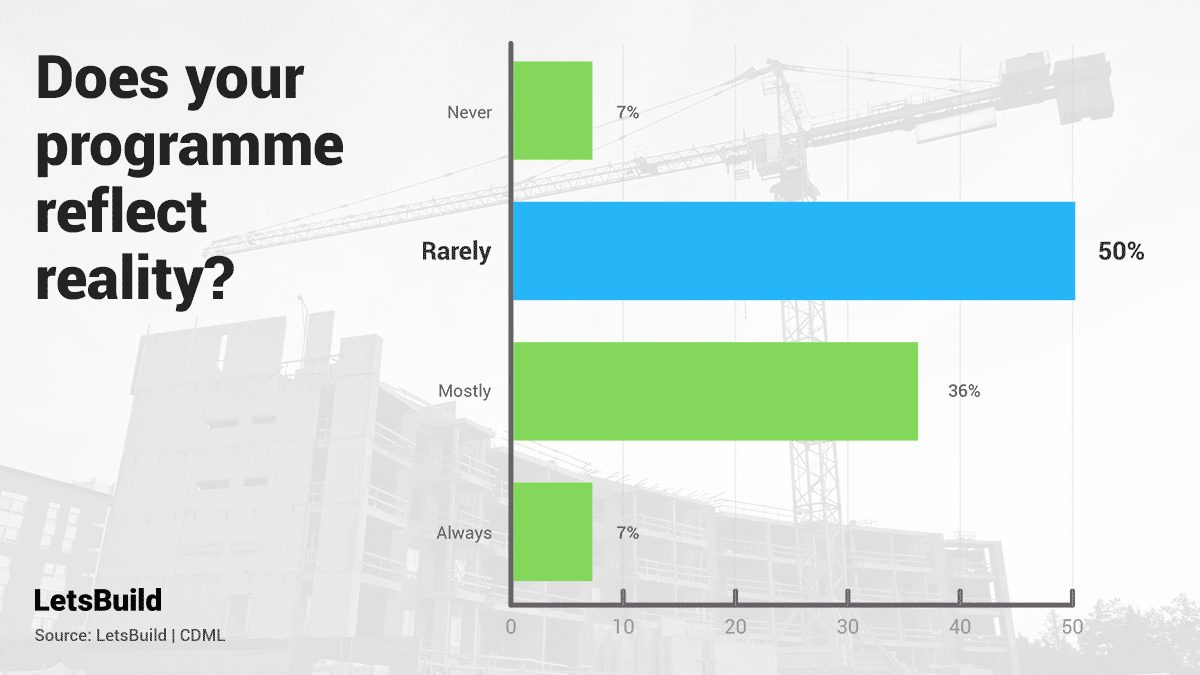

Does your programme reflect reality?

Working on an up-to-date programme is fundamental for the positive outcome of a project. With that in mind, it is almost terrifying to see that only 7% of the CDML participants are confident that their programme reflects reality at any point.

The good news is that there is also a 36% which claim that they work on a well-updated programme most of the time. The problem, though, is that in construction it takes only a moment for a project to go really bad due to miscommunication.

And the absence of an effective reporting and scheduling process can generate a lot of costly misunderstandings forcing people to go back and forth on the construction site waiting for their turn to work on their tasks.

“Collaboration, communication and a much more open approach to sharing of best practice are fundamental for our €10tn per year industry to take the leap ahead that it deserves,” adds Branner.

These troubling numbers highlight the importance of investing in digital adoption. That’s one of the most burning missions for construction companies moving forward. They need to find a framework that will make it easier for the people on the ground to connect with the office in real-time so that the programme will always remain up to date.

A way to achieve that would be by providing on-site personnel with company-paid mobile devices. That’s an area that construction companies should explore more. According to the CDML findings, just 31% of organizations in construction provide smartphones to their entire team. This percentage will gradually increase as construction starts seeing the value of digitalizing its systems and processes.

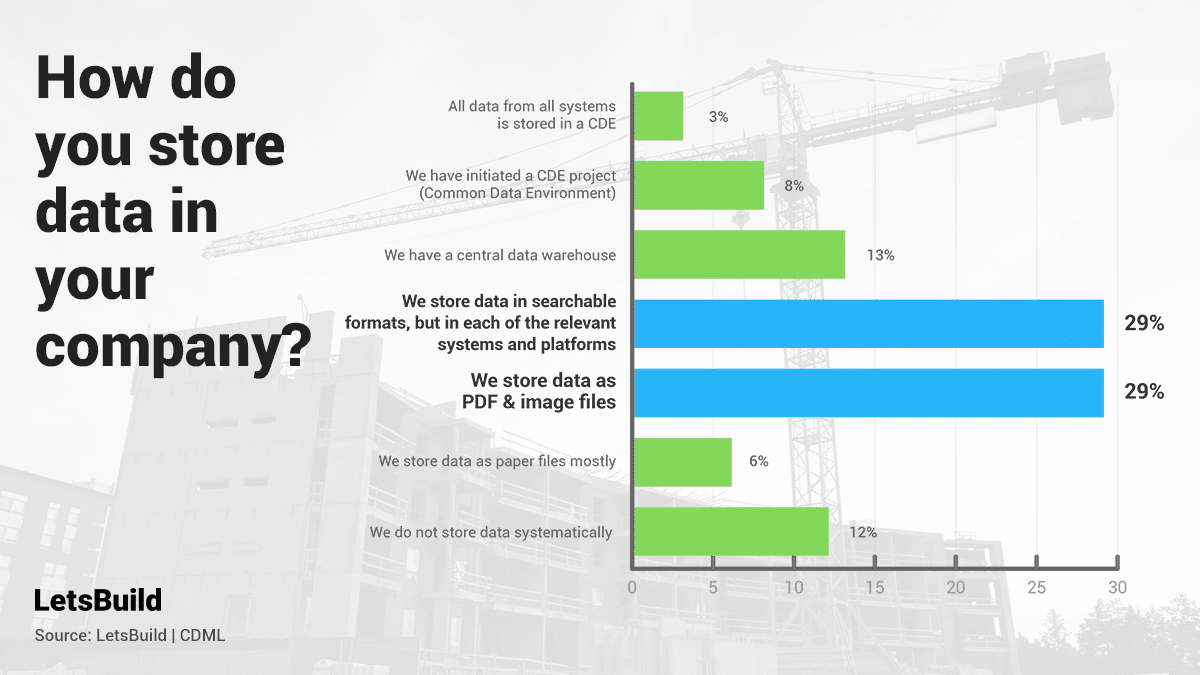

Storing data in a CDE (Common Data Environment) is still at an early stage

Only 3% of the construction sector stores its data in a CDE, while 8% reveals that they have started a CDE project but they are not fully there yet. At the same time, 18% of the CDML respondents admit that they either store their data in paper-format (6%) or they don’t keep it at all (12%).

The graph below verifies the idea that construction is one of the most poorly performing industries when it comes to data storage and analysis. If we try to keep one positive thing, that is the intention of most stakeholders in the sector to keep their data instead of throwing them away or not collecting them at all.

Nevertheless, this data should be accessible by all the different agents in order to bring some value back to the project. Otherwise, everybody is still operating in a very isolated way risking the smooth development of the project.

It’s not everything black or white, though. As construction becomes more digital, it is expected that the way the sector stores and uses its data will change decisively.

For instance, many construction companies and organizations are already taking some brave steps towards BIM and pave the way for a construction process which will rely on an open and highly collaborative digital ecosystem.

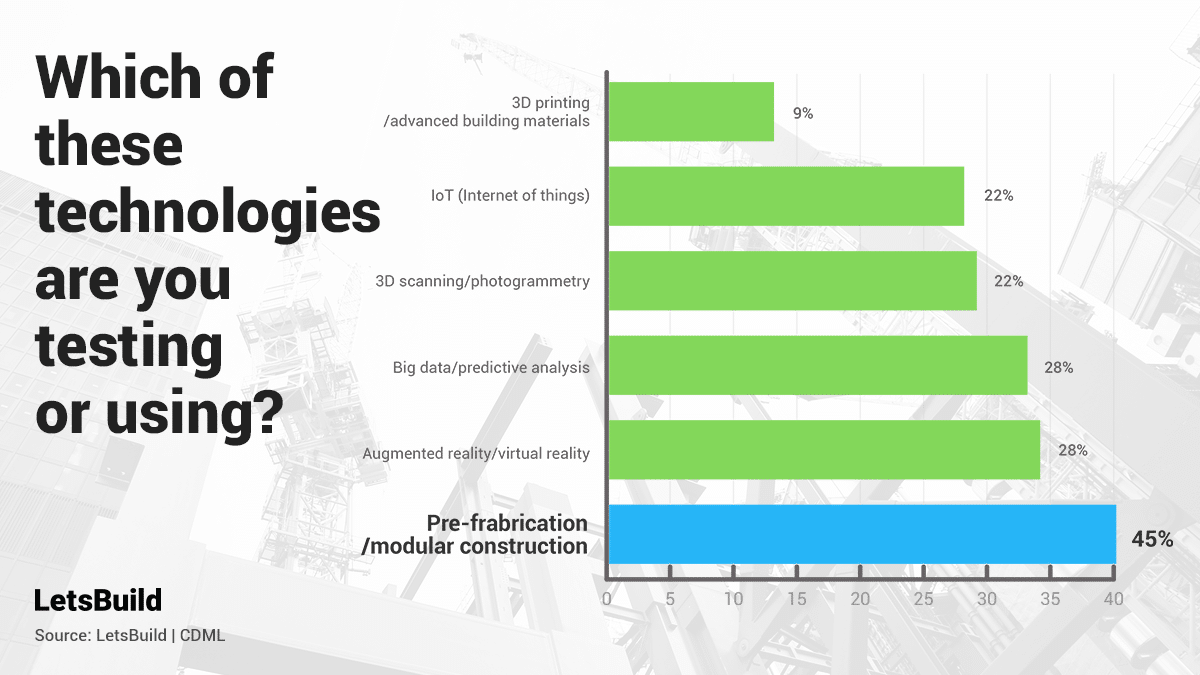

Prefabrication is the hottest trend in construction

Construction is under a deep digital shift but it is extremely interesting to see which areas attract the most attention. Based on the CDML responds, it appears that modular construction and prefabrication is the hottest field in construction technology.

More specifically, 45% refer to prefabrication as the number one technology they are using or testing right now. This result comes as no surprise considering the severe lack of affordable housing in the Western world, the increase of the global population and the stagnation of productivity in the industry.

Big data and augmented/virtual reality are also two areas of interest as a natural continuation of construction’s effort to go digital. In the same aspect, 3D scanning and IoT (Internet of Things) are anticipated to gain some traction as we move forward.

It is very positive that the different players in construction seem to explore their digital future but this needs to be manifested on the resources dedicated to IT investment, as well. Fifteen percent of the CDML participants dedicated up to 3% of their revenue in R&D.

In other words, a big part of the sector still sees digital technologies as a “nice to have” instead of a “must-have”.

Digital tools could lead to cost savings of up to 45%

In a 2017 report of McKinsey, it was suggested that the successful implementation of digital solutions could lead to cost reductions of (up to) 45% for every project in construction.

Considering that we are referring to a sector with a productivity gap of $1.6 trillion, 80% budget overruns and an average 20-month delay per project, it becomes clear that data-driven decision making and a standardized construction process could be the key to a future of positive margins and boosted productivity.

“Data is the bedrock of learning and information and in that sense, it is of paramount importance that construction becomes data-driven,” says Ulrik Branner, executive and board member at LetsBuild.

Measuring the digital maturity of the construction industry can act as a catalyst for meaningful change allowing the different stakeholders to understand their current position to the digital world and compare their progress against their competition.