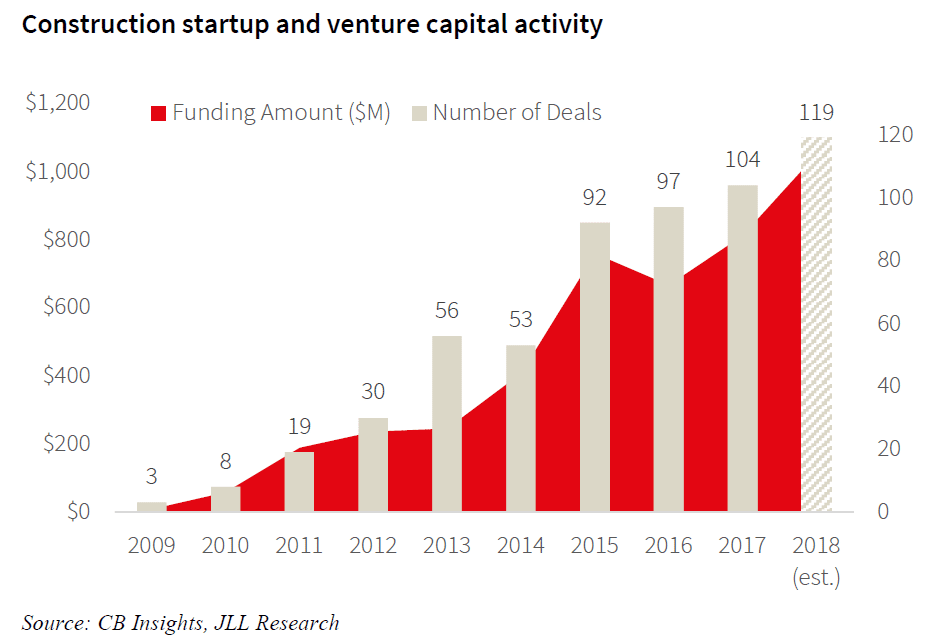

Global construction is expected to reach a total value of $10 trillion in 2020. This number shows the great potential that the sector holds. It is no coincidence that construction technology startups and venture capitalists are lately investing heavily in the industry.

The new report on the state of construction technology, published by JLL, proves that a substantial change is on its way in construction.

Just for the first half of 2018, venture capitalists have invested in construction technology more than $1.05 billion dollars. This number is even more impressing if we take into account the fact that the investment volume has already increased by 30% compared to 2017. And more importantly, there are still five months until the end of the year.

- Originally posted at: Jll.postclickmarketing.com

On top of that, we should mention that construction technology startups attract at the moment more attention from investors than any other type of tech startup in the United States.

The reason behind this hype is the absence of digitisation in the sector. According to McKinsey & Company, construction is the least digitised industry ahead only of agriculture and hunting. This goes to show that there is an area of great opportunity for investors and contech startups.

Digital maturity and adoption have still a long way to go in construction. Nevertheless, the first fragments of hope are visible thanks to the new innovative players who enter the field. The combination of software technology and cutting-edge hardware appears to be a game-changer for the sector. This is also why, data is of integral importance as it is anticipated to unlock new possibilities for construction and the people who work there.

But the lack of digitisation isn’t the only element that has led to this essential change in the field of construction technology. There is a number of factors that have made change in the sector to be regarded as an imminent priority. Just to name a few, labour shortage, cost fluctuations and productivity hiccups are holding the industry far from its true potential.

That being said, there is a strong need for a meaningful shift in construction. The latter can be achieved through digital disruption and groundbreaking changes in the way we design, build and collaborate in the building industry.

It doesn’t take much, then, to understand that venture capitalists and construction technology startups have a unique opportunity to take matters into their own hands through smart and powerful investments in the sector.

A closer look at the current state of construction

In order to gain a better understanding of the industry’s current state, we need to take a step back and look at the bigger picture. Only then, we will be able to detect the main scopes of interest for the sector.

In a nutshell, here are the top five areas of discussion, as reported by JLL:

1. Declined productivity rates

According to the US Bureau of Labor Statistics, almost every industry in the market has managed to double its productivity rate in the course of the last 25 years. Interestingly enough, construction isn’t one of these sectors. To the contrary, construction productivity declined during the same period.

2. Increased material cost

Material costs are continuously rising in construction. During the last 12 months, the cost of building materials has increased by 5.6%. To make matters worse, a new increase of 5-6% is expected in the course of the next year.

3. Skilled labour shortage

The lack of skilled labour is still one of the biggest challenges for the construction industry. The numbers talk for themselves as a decrease of 12.9% has been noted since the 2007 peak. This severe lack of personnel has eventually resulted in a longer project life cycle and significant delays.

Read also: McKinsey & Company – Welcome to the new era of construction technology

4. Resource rivalry

As a natural continuation of the skilled labour shortage crisis, spending in the sector has increased by 23.3% compared to the 2007 peak and it is anticipated to reach $1.8 trillion by the end of 2018.

5. Construction wages are going up

Only in 2017, labour wages went up 4.5% in the sector, while the other industries experienced a wage increase of 2.2%. If we again compare this percentage with the 2007 peak, we will notice that we are talking about an increase of 31.2%.

How ConTech startups can help

Despite the challenges described above, the increase of venture capital and construction technology investment have created room for hope. As the JLL report underlines, in Silicon Valley there is a strong belief that all these obstacles can be overcome through creativity and well-targeted investments.

Like that, it would be possible for construction stakeholders to optimise and automate the construction process and make faster project delivery possible. On top of that, they could ensure that fewer resources will be required for the smooth development and completion of the building process.

In that way, construction technology startups could put an end to a substantial issue: the expansion of construction schedules the continuous increase in labour and material costs.

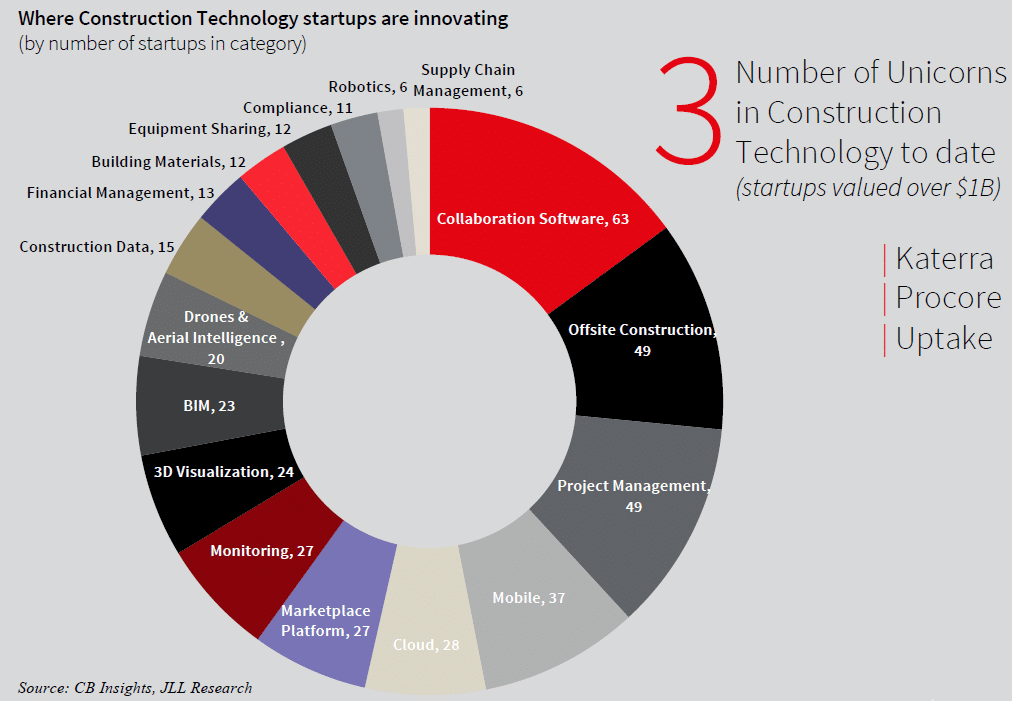

Below, you can take a look at the different ways in which startups are establishing their presence in the contech field:

- Originally posted at: Jll.postclickmarketing.com

The main points of focus for construction technology startups

Contech startups hold great potential for the sector as they can contribute to it in a number of ways. More analytically, here are three of the main areas of focus for startups in construction technology:

Collaboration software

It may sound like a cliche but truth is that collaboration lies at the center of every construction project. A vast number of construction professionals are working together during the building process, exchanging documents, feedback and substantial project updates. All the different members of the team, from architects to general contractors and project managers, have to be on the same page and try their best in order to reduce the time spent on administrative work.

This is where contech startups could help through the development of tools that could empower the connection between the back-office and the construction site. Furthermore, optimise the workflow across the supply chain thanks to real-time updates and data-driven decision-making.

Offsite construction

Modular construction is gradually becoming a popular choice in the sector given the serious skills shortage and the continuously increasing material costs. It’s an alternative approach to the way we design, plan and build in the sector.

There are already some ambitious startups that focus on offsite construction, such as Katerra and Blu Homes. The idea behind offsite construction is the creation of building components in a factory setting and their shipping to the construction site. It is a more automated process that can accelerate the progress of the project and contribute to saving money and resources. Offsite construction is very popular in offshore construction.

Big data and AI

Data is seen today as one of the most valuable resources on the planet. That is no exaggeration if we consider all the power and possibilities that it opens up. Data is present in every stage of the construction process and provide great knowledge and guidance both for ongoing and future projects.

Moreover, thanks to the IoT technology and the use of smart hardware, data can empower the use of artificial intelligence in construction. There are already some strong innovative players in construction that can provide a number of solutions, from automating the material ordering and delivery process to creating visual tours in future structures and promoting the use of self-driven vehicles on site. As the data collection and tracking practices improve, this type of technologies is expected to develop even further in the near future.

Uptake Technologies, Flux Factory and SmartEquip are some of the of startups that you might want to keep an eye on when it comes to big data and AI in construction.

Top 5 ConTech startups based on funding

In an effort to get a better insight into where the construction technology industry is heading to, JLL report presents in detail the top five startups in terms of funding. Offsite construction, cloud-based management software, data and artificial intelligence and materials trading platforms seem to acquire most of the attention, portraying in a way the most imminent needs for the building sector:

[table “49” not found /]

Top 5 ConTech investors

As JLL notices, there is a noticeable diversity in construction technology when it comes to investors and VCs who are interested in entering the sector. Startup accelerator Y Combinator has the most active presence in the field so far. Nonetheless, both tech and real estate investors seem also to come in the industry and invest in ambitious contech ideas. At the same time, corporate investors appear to be more sceptical in regard to their participation in the contech environment. Caterpillar and Google Ventures are the only exceptions so far.

LetsBuild on board with change

There is a very promising future ahead for construction technology startups. In LetsBuild we share the vision for a more productive and data-driven building sector and we are committed to resolving all these project challenges most of which we have experience in the past ourselves.

The emergence of an open data ecosystem consisted of new innovative tech players seems to be around the corner. We want to be part of this integral change and gradually become the digital backbone of the construction process. After all, we are on a mission: To build the future of construction!